Unsplash

The Best Loans to Get Your SB-9 Project Done Faster and Smarter

The housing shortage continues to push California toward new solutions, and SB-9 has become a game changer by allowing homeowners to subdivide lots and build additional units. While the law opens up more opportunities, financing an SB-9 project from start to finish can be challenging, especially with rising construction costs and unexpected delays.

For developers and homeowners leveraging SB-9, keeping a project on schedule and within budget is important. Yet, the reality is that most construction projects exceed their original cost estimates. According to the Construction Management Association of America, 98% of projects run over budget. In other words, nearly 9 out of 10 builds experience financial overruns, as confirmed by the International Journal of Innovation, Management and Technology.

So what happens when an SB-9 project faces setbacks? The right financing options can help get your project back on track and completed.

Unsplash

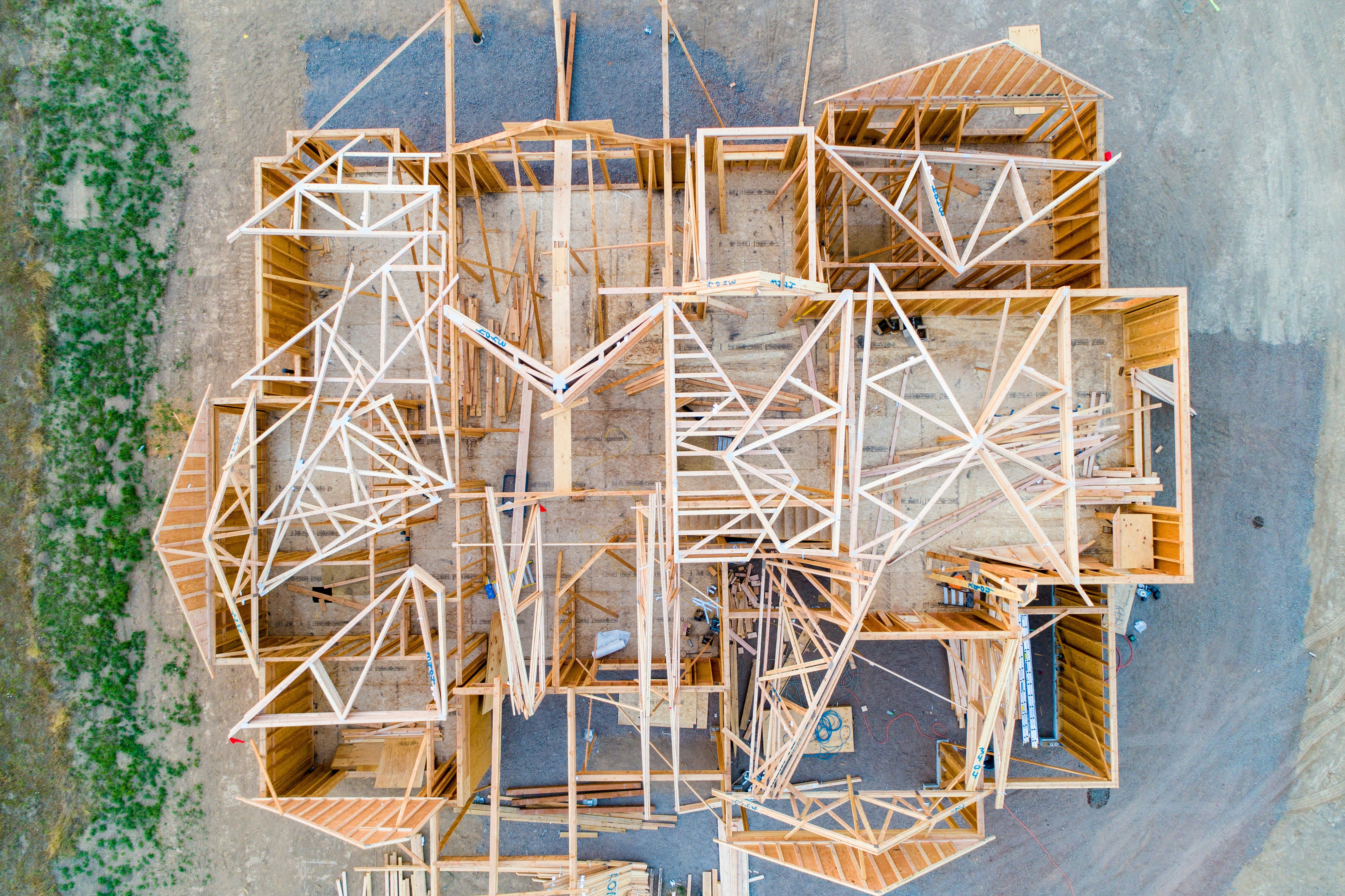

Construction Loans Keep SB-9 Projects Moving

SB-9 projects often require specialized financing, as many traditional lenders hesitate to fund developments that involve lot splits and new construction on subdivided land. Construction loans for SB-9 projects are typically short-term, interest-only loans designed to fund the cost of building duplexes or additional units.

Since lenders view these projects as higher risk, financing often comes with stricter terms, including:

- Shorter loan periods (12–18 months)

- High interest rates

- Draw-based disbursements (funds released in stages as construction progresses)

Developers and homeowners using SB-9 must factor in unexpected costs, as construction material prices remain elevated and labor shortages continue to affect project timelines. A 2022 survey by the Associated General Contractors of America found that over 90% of construction firms struggle to find qualified workers, causing further delays.

If your SB-9 project runs out of funding before completion or your construction loan nears maturity without an extension option, you may face difficult choices:

- Rushing to complete the project with compromised quality to avoid penalties.

- Requesting a loan extension, which may come with high fees—or may not be available at all.

- Refinancing the project to secure more funding, extend loan terms, and prevent costly delays.

The Problem with Construction Loan Extensions

Many developers assume they can extend a construction loan if they fall behind schedule, but the lending environment has changed significantly.

Until early 2023, regional and local banks controlled 31% of construction loans, while banks of all sizes accounted for 60%. However, when regional banks faced liquidity crises, many stopped offering construction loan extensions. Those that still do charge steep fees.

For SB-9 developers working within tight budgets, these fees can quickly derail a project. A 1% extension fee on a $1.5 million construction loan would cost $15,000 out of pocket.

The Better Alternative

When an SB-9 project is nearly finished but funding is running low, a construction completion loan can help bridge the gap.

This financing solution replaces an existing loan with better terms, offering:

- More time to complete the project and sell or rent the units.

- Additional funds to cover unexpected construction costs.

- A cash-neutral structure, where loan costs are rolled in to avoid out-of-pocket payments.

Unsplash

Who Qualifies for This Loan?

To secure this type of financing for an SB-9 project, lenders typically look for:

- A project at least 75% complete, with essential exterior work done (foundation, framing, roofing, sidings, doors, and windows installed).

- Major interior systems completed, including rough plumbing, electrical, and HVAC.

- No mechanic’s liens on the property, ensuring all contractors and suppliers have been paid.

How a Retired Couple Used a Construction Completion Loan to Secure Their SB-9 Investment

A retired couple in Sacramento wanted to generate passive income by splitting their large lot under SB-9 and building two new duplexes for rental income. They secured a $3.5 million construction loan from a regional bank to finance the project. However, unexpected material price increases and contractor delays left them short on funds, with key interior work still unfinished. Complicating matters, their loan was set to mature in just a few months, putting their investment at risk.

To avoid costly penalties and ensure their project remained high-quality, they secured a 12-month construction completion loan at 85% loan-to-cost (LTC). The new loan provided an additional $700,000, bringing the total to $4.2 million. With the extra funding, they were able to finish the interiors with quality materials and lease the units at competitive market rates, securing a strong and steady rental income for their retirement.

Securing the Best Loan for Your SB-9 Project

If your SB-9 project is at risk due to loan maturity, budget overruns, or unforeseen delays, securing a construction completion loan could be the key to staying on track. However, not all lenders offer this type of financing, so it’s essential to work with one that understands the complexities of SB-9 developments.

With the right financing, builders and homeowners can avoid rushed construction, maintain project quality, and secure the profit potential of their SB-9 investment—without falling into the trap of high extension fees or stalled progress.

Could a construction completion loan help your SB-9 project succeed? Research lenders who have already completed financing an SB-9 project to find the best option for your development.

Find out how much market value has your property gained with SB-9

Related Articles ...

What the New SB-9 Housing Law Means for Single-Family Zoning in California

Resources